Top Affordable Life Insurance Picks for 2025

- dustinjohnson5

- Apr 9

- 22 min read

Protecting Your Family's Future Without Breaking the Bank

Finding affordable life insurance can be challenging. This listicle simplifies the process by highlighting ten providers offering budget-friendly options. Discover key features, pros, and cons of each company—from well-established names like State Farm and Northwestern Mutual to innovative online platforms like Haven Life and Bestow—to secure your family's financial future without overspending. These tools cut through the complexity of comparing policies, helping you find the right coverage at the right price.

1. America First Financial

America First Financial caters to conservative Americans seeking insurance solutions aligned with their values. They offer a range of products including term life, disability, annuities, long-term care, and comprehensive health care plans, aiming to provide a one-stop shop for family protection and financial well-being. This makes them a potentially attractive option for families concerned about future stability, individuals approaching retirement, and those prioritizing health coverage within a framework of traditional values. The company emphasizes a commitment to avoiding politically charged agendas found in some mainstream insurance providers, which resonates with their target audience. Whether you’re looking to secure your family’s future with life insurance, plan for a comfortable retirement with annuities, or ensure access to quality healthcare, America First Financial aims to offer options tailored to a conservative perspective.

One of the key features of America First Financial is its streamlined online quote system. You can get a personalized insurance quote in under three minutes, which significantly simplifies the often tedious process of comparing insurance options. This fast and user-friendly approach, combined with a promise of no persistent follow-ups, caters to busy individuals who value efficiency and prefer to avoid high-pressure sales tactics. While specific pricing details aren't readily available on the website, the company emphasizes its commitment to affordability, suggesting it aims to compete on price with more traditional insurers. This focus on affordability makes it potentially beneficial for budget-minded shoppers.

Further enhancing its appeal, a portion of every dollar earned by America First Financial is donated to philanthropic causes. This commitment to community support and traditional values reinforces the company's brand identity and may attract individuals who prioritize socially responsible businesses. The endorsement of public figures like Donald Trump Jr. provides additional social proof and strengthens its credibility within its target demographic.

Pros:

Affordable: Focuses on providing cost-effective insurance solutions.

Values-Aligned: Caters specifically to conservative values and principles.

Fast & Easy Quotes: Obtain personalized quotes online in under three minutes.

Comprehensive Coverage: Offers a wide range of insurance products.

Philanthropic Commitment: Donates a portion of earnings to charitable causes.

Cons:

Targeted Audience: The focus on conservative values may limit its broader appeal.

Potential for Limited Customization: May offer less flexibility for highly specialized insurance needs.

America First Financial earns its place on this list by offering a streamlined, values-driven approach to insurance. Its fast quoting process, emphasis on affordability, and commitment to philanthropic causes make it a compelling option for conservative American families, individuals approaching retirement, and budget-conscious consumers seeking coverage that aligns with their principles. However, those seeking highly customized or niche insurance solutions might find its offerings less flexible compared to some broader market competitors.

2. Haven Life

Haven Life offers a convenient and potentially cost-effective way to secure term life insurance, particularly for those who value a quick and easy digital experience. This online platform, backed by the financial strength of MassMutual (an A++ rated insurer by AM Best), specializes in term life policies, offering coverage amounts from $100,000 to $3 million with terms ranging from 10 to 30 years. This makes it a practical option for a range of needs, whether you're a young family seeking protection during child-rearing years, an individual approaching retirement looking to cover final expenses, or simply a budget-minded shopper looking for affordable coverage.

One of Haven Life's most attractive features is its InstantTerm process. Eligible applicants can receive an immediate coverage decision without a medical exam, potentially streamlining the entire process to as little as 25 minutes. This is a significant advantage for healthy individuals who want coverage quickly and prefer to avoid the time and hassle of a medical exam. For those seeking higher coverage amounts, a medical exam may still be required. While pricing varies based on factors like age, health, and coverage amount, Haven Life is known for its competitive rates, especially for younger, healthier applicants.

For conservative American families, the stability and long-standing history of MassMutual, combined with Haven Life's streamlined digital application, provides a reassuring blend of tradition and modern convenience. Individuals approaching retirement can utilize Haven Life's term policies to cover final expenses and other immediate needs, providing peace of mind for themselves and their loved ones. Health-conscious consumers will appreciate the potential for bypassing the medical exam with the InstantTerm process. Budget-minded insurance shoppers will find Haven Life’s transparent online platform and competitive rates particularly appealing.

Implementation Tips:

Be Honest: Even though the InstantTerm option doesn't require a medical exam, it's crucial to answer all health questions accurately. Inaccurate information could jeopardize your coverage later.

Compare Quotes: Use Haven Life's online quoting tool to get a personalized estimate. It's also wise to compare quotes from other insurers to ensure you're getting the best possible rate.

Explore the Perks: Haven Life offers additional benefits beyond the life insurance policy itself, such as a free online will creation tool and a digital secure vault for storing important documents. These perks can add significant value.

Pros:

Entirely online application process, potentially taking as little as 25 minutes.

Competitive rates, particularly for younger, healthy applicants.

No-commission agents, eliminating potential sales pressure.

30-day money-back guarantee.

Backed by the financially strong MassMutual.

Cons:

No whole life or universal life insurance options are available.

Not available to individuals over age 64.

Higher coverage amounts often require a medical exam.

Website: https://havenlife.com/

Haven Life earns its place on this list by providing a user-friendly digital experience, combined with the financial security of being backed by MassMutual. Its focus on term life insurance, coupled with its InstantTerm option, makes it a particularly attractive option for those seeking affordable and easily accessible coverage.

3. Bestow

Bestow offers a streamlined, fully online approach to term life insurance, making it an attractive option for busy families, individuals nearing retirement, or anyone prioritizing convenience and speed. It distinguishes itself by eliminating the need for medical exams, which can be a significant time saver and a plus for those who are uncomfortable with needles or medical procedures. This entirely digital process caters to today's fast-paced lifestyles, providing peace of mind quickly and efficiently. Imagine securing financial protection for your loved ones in the time it takes to order a pizza – that's the kind of speed Bestow offers. This focus on accessibility makes it a valuable tool for budget-minded shoppers and those seeking a hassle-free experience.

Bestow provides term life insurance policies ranging from $50,000 to $1.5 million, with terms of 10, 15, 20, 25, or 30 years. This flexibility allows you to tailor your coverage to specific needs, whether it's covering a mortgage, providing for your children's education, or ensuring a comfortable retirement for your spouse. Individuals aged 18-60 are eligible, although the age limits vary based on the chosen term length. While Bestow doesn't disclose specific pricing details upfront (as rates are personalized based on individual factors), its no-exam approach generally results in competitive premiums within this market segment. For example, a healthy 30-year-old non-smoker could potentially secure a $500,000, 20-year term policy for a reasonable monthly premium. It's worth comparing Bestow's quotes with other no-medical-exam providers like Ladder or Haven Life to ensure you are getting the best possible value.

Setting up a policy with Bestow is remarkably simple. The entire application process takes place online at https://www.bestow.com/ and can often be completed in under 10 minutes. You'll answer a few health and lifestyle questions, and Bestow's algorithm will provide an instant decision. This swift turnaround eliminates the anxiety of waiting weeks for approval. Furthermore, Bestow offers a 30-day money-back guarantee, providing an additional layer of assurance for those who are new to life insurance or hesitant to commit.

Pros:

Speed and Convenience: The entirely online application and instant decisions are ideal for busy individuals and families.

No Medical Exams: This eliminates the need for needles, doctor's visits, and lab work.

Competitive Pricing: Bestow offers competitive rates for no-exam term life insurance.

User-Friendly Interface: The website and application process are designed for ease of use.

30-Day Money-Back Guarantee: Provides peace of mind and allows for a risk-free trial.

Cons:

No Permanent Life Insurance: Bestow currently only offers term life insurance, not whole life or universal life policies.

Age and Coverage Limits: The maximum coverage amount and age limits may be lower than some competitors.

No Medical Exam Option: Those who prefer to undergo a medical exam for potentially lower rates won't have that option with Bestow.

Bestow deserves a spot on this list because it democratizes access to life insurance by making it faster, simpler, and more affordable. It's a particularly strong option for healthy individuals who value convenience and want to secure coverage quickly. While it may not be suitable for everyone (especially those seeking permanent coverage or higher coverage amounts), its user-friendly platform and rapid approval process make it an excellent choice for many American families, especially those who prioritize budget and efficiency.

4. Fabric

Fabric stands out as a particularly strong choice for young families seeking affordable term life insurance. Their emphasis on simplicity and digital convenience, combined with valuable financial planning tools, makes securing your family's future a straightforward process. This makes them an excellent option for budget-minded individuals and families who prioritize efficient, online solutions. They cater to the needs of busy parents who appreciate a quick and easy application process, accessible from anywhere via their mobile app.

Fabric offers term life insurance policies ranging from $100,000 to $5 million, with term lengths of 10, 15, 20, 25, or 30 years. This flexibility allows you to customize your coverage to fit your specific needs and budget. For example, a young family with a mortgage and young children might opt for a larger policy with a longer term (like 20 or 30 years), while someone closer to retirement might choose a smaller policy with a shorter term (10 or 15 years) to cover remaining debts or final expenses. The accelerated underwriting option, available for eligible applicants, can significantly speed up the approval process, potentially eliminating the need for a medical exam. This is a major plus for busy individuals and those who prefer a streamlined, no-fuss approach.

Beyond just life insurance, Fabric provides valuable tools designed to empower families financially. Their free online will creation tool, included with all policies, simplifies estate planning and ensures your assets are distributed according to your wishes. This is especially important for young families with children. The family financial dashboard provides a centralized location to organize accounts and beneficiaries, simplifying financial management and offering peace of mind. These added benefits contribute to a holistic approach to family financial wellness, aligning with the values of conservative American families seeking security and stability.

Implementation Tip: Fabric's online application process is designed to be quick and user-friendly, often taking as little as 10 minutes to complete. You can manage your policy entirely through their mobile app, providing convenient access and control.

Pros:

Speed and Convenience: The application process is fast and can be completed online or via their mobile app.

Affordability: Fabric is known for its competitive rates, particularly for young parents.

Added Value: The included will creation tool and financial dashboard offer substantial added value at no extra cost.

Cons:

No Permanent Options: Fabric focuses solely on term life insurance and doesn't offer permanent policies like whole life or universal life.

Age Limits: The maximum issue age for most term lengths is 60.

Medical Exams: While accelerated underwriting is available for some, others may still require a medical exam.

Fabric earns its place on this list by providing affordable term life insurance tailored for young families, combined with practical financial planning tools. Its commitment to simplicity and digital convenience caters to the needs of today's busy families while ensuring financial security for the future.

5. Ladder

Ladder distinguishes itself in the affordable life insurance market by offering flexible, term life coverage that adapts to your evolving financial needs. This is particularly appealing to budget-minded insurance shoppers and those approaching retirement who may anticipate shifts in their financial obligations. Unlike traditional policies that lock you into a fixed coverage amount, Ladder allows you to decrease or apply to increase your coverage without incurring fees or navigating complicated processes. This adaptability can provide peace of mind, knowing your life insurance can adjust alongside major life events like paying off a mortgage, children leaving for college, or changes in income.

Ladder's policies are issued by Allianz Life Insurance Company of New York and Fidelity Security Life Insurance Company, both highly-rated and financially secure institutions, which provides an additional layer of confidence for conservative American families. Coverage amounts range from $100,000 to $8 million, with term lengths of 10, 15, 20, 25, or 30 years, allowing you to tailor the policy to your specific requirements. The entirely digital application process is streamlined and efficient, often providing instant decisions for eligible applicants. For qualified individuals, coverage up to $3 million may be available without a medical exam, a significant advantage for health-conscious consumers and those seeking quick and convenient coverage.

One of Ladder's key strengths is its price lock guarantee. This means your premium remains the same throughout the policy term, providing budget predictability and protection against future premium hikes. The absence of commission agents also contributes to potentially lower premiums, passing the savings on to the customer. For budget-minded individuals, this transparent and commission-free structure is a compelling advantage.

While Ladder offers significant advantages, it's essential to also consider its limitations. The platform currently doesn't offer riders to customize policies, nor does it provide whole life or universal life insurance options. While many applicants may qualify for coverage without a medical exam, higher coverage amounts and certain applicant profiles will require one.

Implementation Tip: When applying for coverage with Ladder, have all your necessary financial information readily available, including income details, debts, and existing insurance policies. This will expedite the application process.

Why Ladder Deserves its Place: Ladder offers a fresh approach to term life insurance, prioritizing flexibility and affordability. Its dynamic coverage options, combined with a streamlined digital application and price lock guarantee, make it a valuable tool for individuals and families seeking a cost-effective and adaptable life insurance solution. For individuals and families navigating financial change, or those simply seeking a user-friendly experience, Ladder offers a strong value proposition. Visit their website at https://www.ladderlife.com/ to explore your options.

6. State Farm

State Farm, a household name synonymous with insurance in America, offers a reassuringly traditional approach to life insurance. This makes them a solid choice for those who value personalized service and prefer face-to-face interactions when making significant financial decisions. They provide a comprehensive suite of life insurance products designed to meet a variety of needs, from young families just starting out to individuals approaching retirement. If you appreciate the peace of mind that comes with a well-established company and local support, State Farm is worth considering. Their focus isn't solely on rock-bottom prices, but on building long-term relationships and offering comprehensive financial guidance.

State Farm offers term, whole life, and universal life policies. Term life, a popular choice for young families, is available in 10, 20, and 30-year terms, allowing you to align your coverage with specific financial goals like paying off a mortgage or funding a child's education. Their "Select Term" option offers level premiums throughout the chosen term and can be converted to permanent coverage later, providing flexibility as your needs evolve. For those seeking lifelong coverage and a cash value component, whole life and universal life policies are available with varying customization options. They also offer a Return of Premium option on certain term policies, appealing to budget-minded individuals who want a refund of premiums paid if they outlive their policy term.

For the Conservative American Family: State Farm’s long-standing presence in the community and strong financial ratings (A++ from AM Best) provide peace of mind and align with traditional values. The option to bundle life insurance with auto or home insurance can lead to substantial discounts, making it a cost-effective choice for families.

For Individuals Approaching Retirement: Whole life insurance can be a valuable tool for estate planning and leaving a legacy for loved ones. A State Farm agent can help navigate these complex decisions and tailor a policy to specific needs.

For Health-Conscious Consumers: While medical exams are typically required, working with a local agent can help streamline the process and address any health concerns. This personalized guidance ensures you find the right policy based on your individual health profile.

For Budget-Minded Insurance Shoppers: While State Farm may not always have the absolute lowest premiums compared to some online competitors, the potential for bundling discounts and the Return of Premium option on certain term policies can make them a competitive option.

For Patriotic Individuals: As a long-standing American company, State Farm resonates with those who prefer to support domestic businesses.

Implementation Tip: Reaching out to a local State Farm agent is the best way to get started. They can provide personalized quotes, answer your questions, and guide you through the application process. Be prepared to provide detailed health information and undergo a medical exam. While the process may take a bit longer than with online-only providers, the personalized advice and potential for bundled discounts can be worth the extra effort.

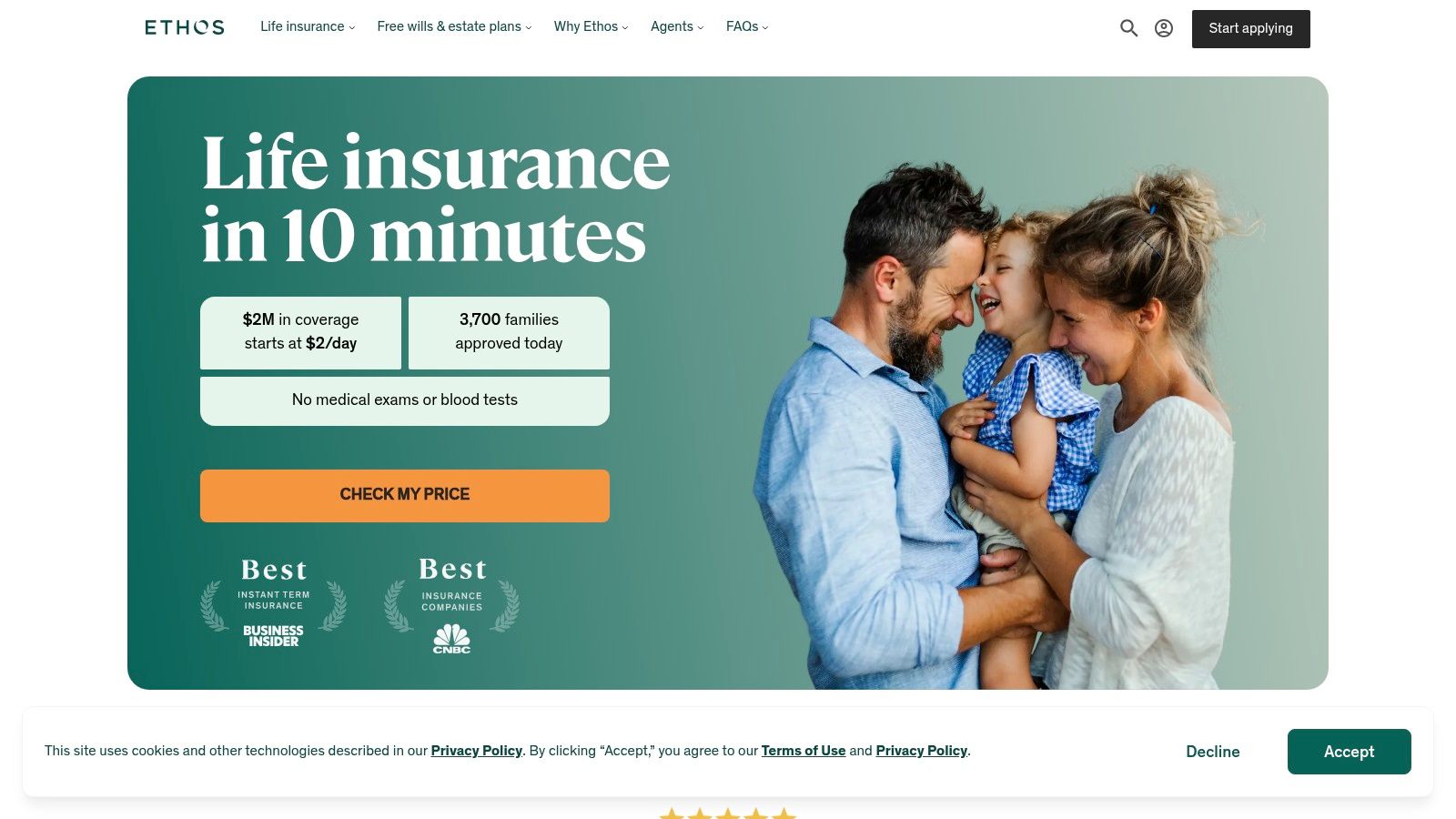

7. Ethos

Ethos distinguishes itself through its commitment to simplifying the often daunting process of applying for life insurance. Their platform leverages technology to make life insurance more accessible, particularly for those comfortable with online applications and who value speed and efficiency. This approach can be especially appealing to budget-minded individuals and families looking for competitive rates without the traditional sales pressure. Whether you're a young professional just starting a family, approaching retirement, or simply looking to secure your financial future, Ethos offers a streamlined way to explore and acquire coverage.

Ethos primarily focuses on term life insurance, offering coverage amounts from $20,000 to $2 million with term lengths of 10, 15, 20, or 30 years. This flexibility allows you to tailor your coverage to match specific needs, such as paying off a mortgage, covering children's education expenses, or providing income replacement for a surviving spouse. For individuals between the ages of 66 and 85, Ethos also offers whole life insurance, which provides lifelong coverage and a cash value component that grows over time. This can be a suitable option for those seeking financial security and legacy planning in their later years.

A key advantage of Ethos is its data-driven underwriting process. Using predictive analytics, they can often determine eligibility and offer competitive rates without requiring a medical exam. This can significantly expedite the application process, with policy decisions sometimes available in minutes for eligible applicants. While some applicants may still need a medical exam, the streamlined process makes acquiring life insurance far less time-consuming and potentially less stressful than traditional methods. This is especially valuable for busy families and individuals nearing retirement who value their time.

Implementation and Setup: The application process is entirely online, making it convenient and accessible. You'll answer a series of questions about your health and lifestyle, and Ethos's algorithms will assess your risk profile. This digital approach eliminates the need for face-to-face meetings with agents, allowing you to complete the application at your own pace.

Comparison: Similar to other online life insurance platforms like Ladder and Haven Life, Ethos emphasizes speed and convenience. However, Ethos broadens its appeal by offering whole life insurance, although this option is limited to older applicants. This makes it a more versatile option than purely term-life focused platforms.

Pros:

Simple online application: Streamlined process, often without a medical exam.

No-commission agents: Transparent pricing with no hidden fees or sales pressure.

Affordable rates: Data-driven underwriting often leads to competitive pricing.

Coverage for a wide age range: Caters to individuals aged 20 to 85.

Cons:

Limited policy customization: Options may be less flexible than some traditional insurers.

Whole life insurance only for older applicants: Not suitable for younger individuals seeking permanent coverage.

Medical exam may still be required: While often bypassed, some applicants might still need a medical exam depending on their health profile.

Website: https://www.ethoslife.com/

Ethos earns a place on this list due to its accessible and efficient online application process, its commitment to transparency through no-commission agents, and its data-driven approach to underwriting. For conservative American families, individuals nearing retirement, or budget-conscious consumers, Ethos offers a user-friendly and often more affordable pathway to securing critical life insurance protection.

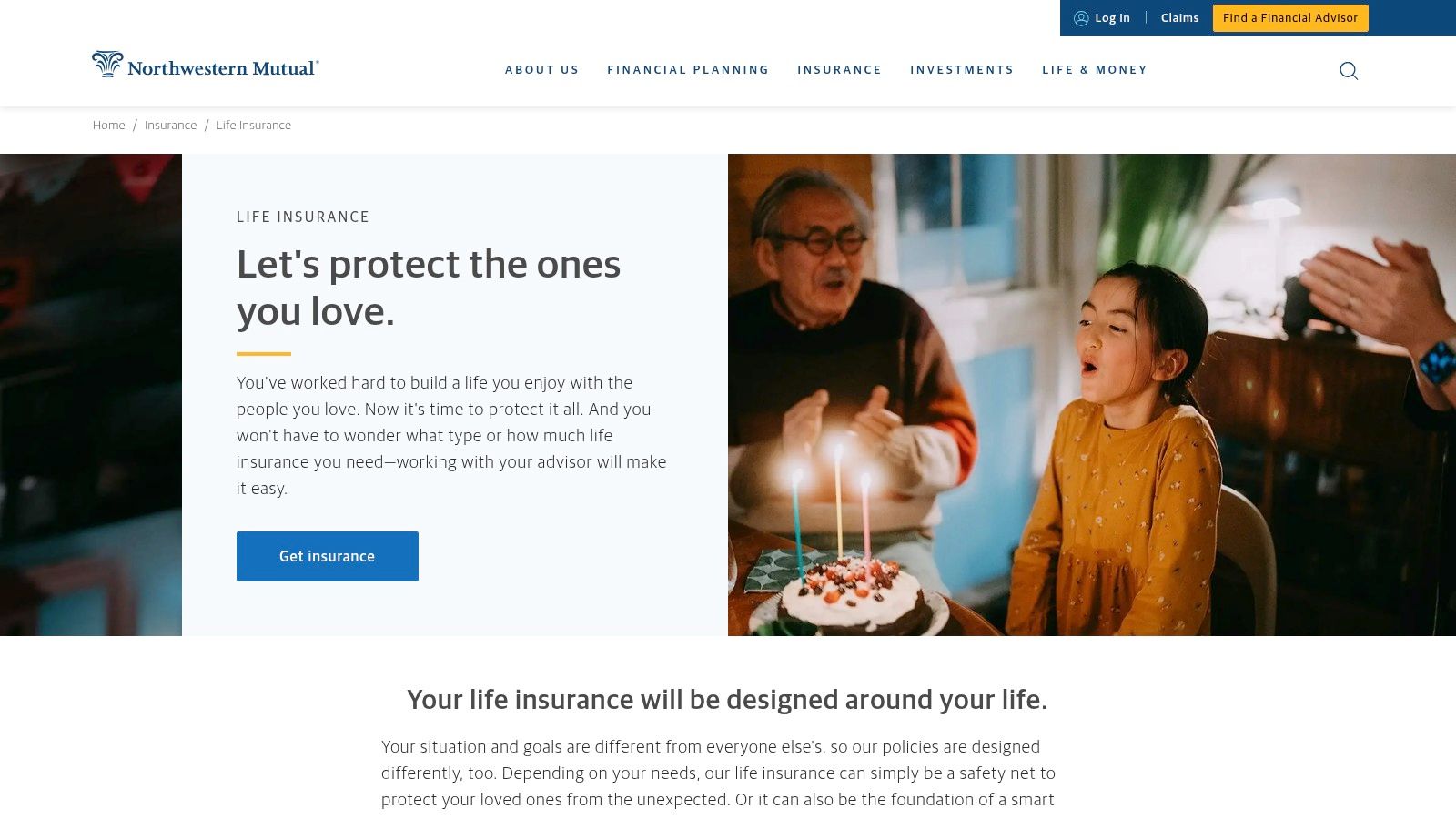

8. Northwestern Mutual

Northwestern Mutual distinguishes itself through a focus on personalized financial planning integrated with its insurance offerings. This approach makes them a strong contender for individuals and families seeking long-term financial security, especially those prioritizing robust permanent life insurance options. Think of them as a financial partner rather than just an insurance provider. They aim to help you build a comprehensive financial strategy, with life insurance as a key component. This makes them particularly appealing to conservative American families who value stability and long-term growth, individuals approaching retirement who are consolidating their financial portfolios, and those who prefer working directly with a financial advisor for personalized guidance.

Northwestern Mutual offers a wide array of life insurance products, including term life, whole life, universal life, and variable universal life insurance. This range allows for a tailored approach, addressing various needs and financial goals. For example, a young family might opt for affordable term life insurance to cover mortgage payments and childcare expenses should the unexpected happen. Conversely, someone nearing retirement might choose a whole life policy to supplement retirement income and leave a legacy for their loved ones.

While specific pricing information isn't readily available online, Northwestern Mutual is known for its competitive rates, especially for permanent life insurance products. Their participating whole life policies, in particular, have a history of strong dividend performance, adding to the policy's cash value over time. These dividends, while not guaranteed, offer the potential for tax-advantaged growth and can be used to reduce premiums, increase coverage, or be taken as cash. This focus on long-term value and financial strength aligns well with the values of conservative investors and those seeking financial stability.

Features and Benefits:

Comprehensive Product Range: From basic term coverage to complex variable universal life, Northwestern Mutual offers a policy to suit various needs and budgets.

Dividend Performance: Participating whole life policyholders benefit from potential dividend payouts, reflecting the company's financial strength and contributing to long-term growth.

Personalized Financial Planning: Working with a dedicated financial advisor offers customized solutions and integrates insurance into a broader financial strategy.

Convertible Term Options: Flexibility to convert term policies to permanent coverage without further medical exams provides long-term security as needs evolve.

Variety of Riders: Customize your policy with riders for disability income, long-term care, and more to enhance protection.

Pros:

Financial Strength: Boasting top ratings from agencies like AM Best (A++), Northwestern Mutual provides confidence in its ability to meet its obligations.

Consistent Dividends: Though not guaranteed, the company has a strong track record of paying dividends to participating policyholders.

Tailored Advice: Personalized guidance from a financial advisor helps create a comprehensive financial plan.

Strong Cash Value Growth: Permanent policies generally offer robust cash value accumulation compared to industry averages.

Cons:

Application Process: Requires a medical exam and working with a financial advisor, leading to a longer application process compared to online-only insurers.

Premium Costs: Premiums may be higher than those offered by online-only term life insurance providers.

Advisor Dependence: The process relies on working with an advisor, which might not suit those who prefer managing their finances independently.

Implementation Tips:

Prepare for the Medical Exam: Be honest and upfront about your health history to avoid delays in the application process.

Discuss Your Long-Term Goals: Openly communicate your financial objectives with your advisor to ensure the chosen policy aligns with your overall strategy.

Compare Quotes: While Northwestern Mutual offers competitive permanent life insurance rates, it's always wise to compare quotes with other providers.

Northwestern Mutual’s emphasis on financial strength, personalized service, and comprehensive planning earns it a spot on this list. Its approach resonates particularly well with individuals prioritizing long-term financial security and those who prefer a collaborative relationship with a financial advisor. While the application process is more involved and premiums may be higher than some online competitors, the potential benefits of strong dividend performance, personalized service, and robust cash value growth make it a valuable option for the right individual. It’s an especially good fit for those seeking a holistic approach to financial planning, where life insurance plays a key role in achieving long-term goals.

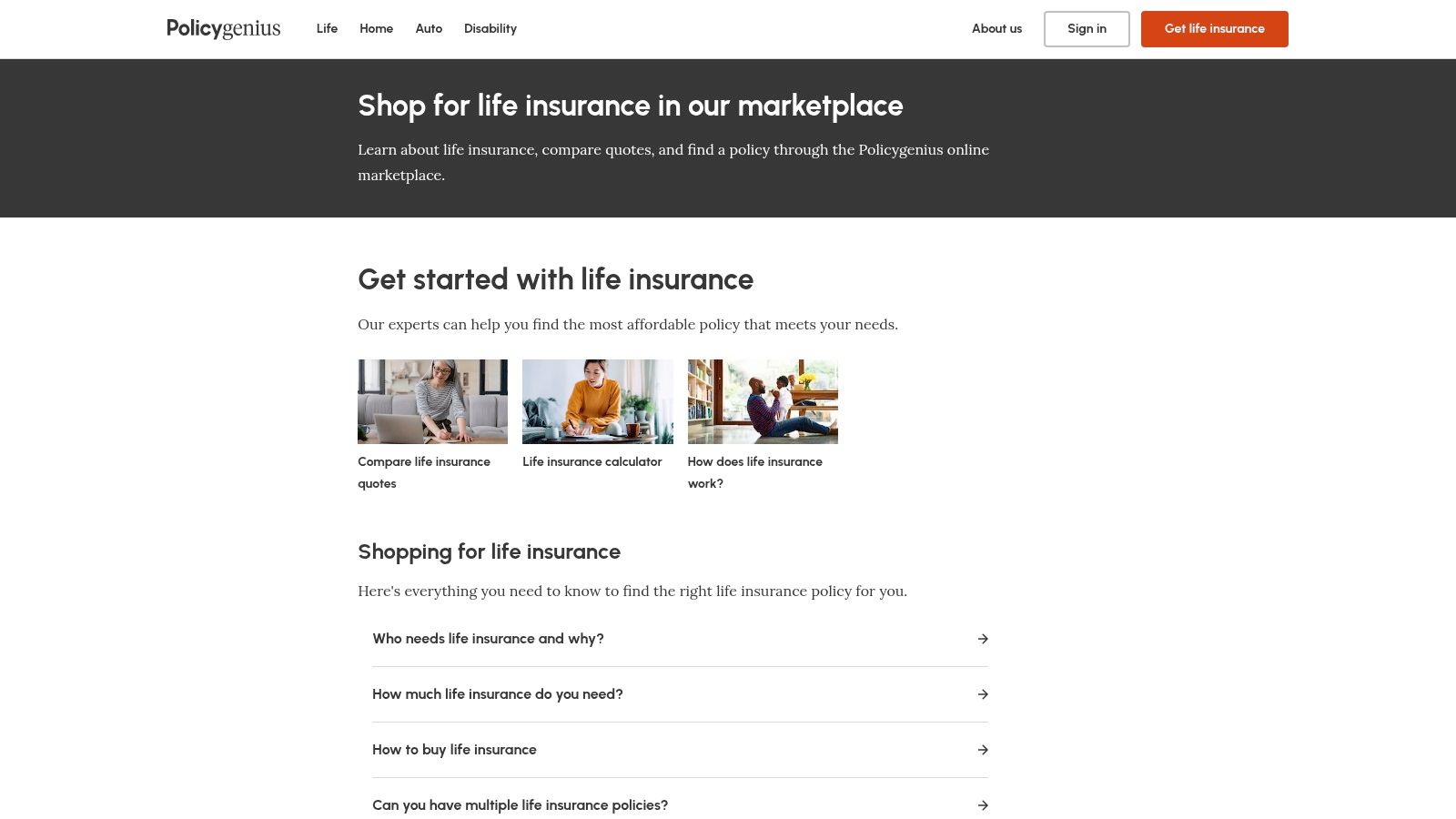

9. Policygenius

Finding affordable life insurance can feel like navigating a maze, especially with so many companies and policy types available. Policygenius aims to simplify this process by acting as a one-stop shop for comparing quotes from multiple top-rated life insurance providers. This makes it a valuable tool for budget-minded insurance shoppers, families planning for the future, and individuals approaching retirement who want to secure their financial legacy. Instead of contacting numerous insurers individually, you can use Policygenius to see a range of options side-by-side, saving you considerable time and effort.

Policygenius offers access to term, whole, and universal life policies, catering to a variety of needs and financial goals. For example, a young family might prioritize the affordability of term life insurance, while someone closer to retirement might be interested in the cash value component of a whole life policy. This breadth of options makes Policygenius a suitable tool for a wide range of users, including conservative American families looking for long-term financial security.

One of Policygenius's key features is access to non-commissioned advisors. These experts can provide unbiased guidance, helping you understand the nuances of different policies and choose the best fit for your circumstances. This is especially beneficial for those who feel overwhelmed by the complexities of insurance or simply prefer personalized support. This feature aligns well with the needs of health-conscious consumers who might have specific questions about coverage related to pre-existing conditions.

Features and Benefits:

Comparison Shopping: Obtain quotes from multiple insurers in one place, allowing you to compare coverage amounts, premiums, and policy features.

Variety of Policy Types: Explore term, whole, and universal life insurance options to find the right fit for your needs and budget.

Unbiased Advice: Receive guidance from non-commissioned advisors who can answer your questions and help you make informed decisions.

Price Match Guarantee: Policygenius offers a price match guarantee for comparable policies, ensuring you get a competitive rate.

Digital Dashboard: Manage your application process online, track your progress, and access your policy documents conveniently.

Pros:

Time Savings: Comparing multiple quotes simultaneously streamlines the research process.

Expert Guidance: Access to non-commissioned advisors provides objective support.

Wide Selection: Choose from a variety of insurers and policy types.

Ongoing Support: Policygenius offers free policy reviews and support even after your purchase.

Cons:

Application Time Varies: The application process and timeline depend on the chosen insurer.

Limited Insurer Network: Not every insurance company partners with Policygenius.

Medical Exams Often Required: Final pricing often requires a medical exam, which can be a barrier for some.

Implementation/Setup Tips:

Using Policygenius is straightforward. Visit their website (https://www.policygenius.com/life-insurance/), answer a few questions about your needs and health, and the platform will generate quotes from various insurers. You can then compare the options, contact an advisor for further clarification, and proceed with the application process through the Policygenius platform.

While Policygenius offers a valuable service, it's important to remember that it's not an insurance company itself. They act as an intermediary. This means that the final underwriting and policy issuance will be handled by the insurer you select. Similar platforms like SelectQuote and Quotacy offer comparable services. However, Policygenius distinguishes itself through its combination of comprehensive comparison shopping, expert advice, and ongoing support. This makes it a particularly attractive option for patriotic individuals who value American companies providing helpful services and supporting families in their financial planning.

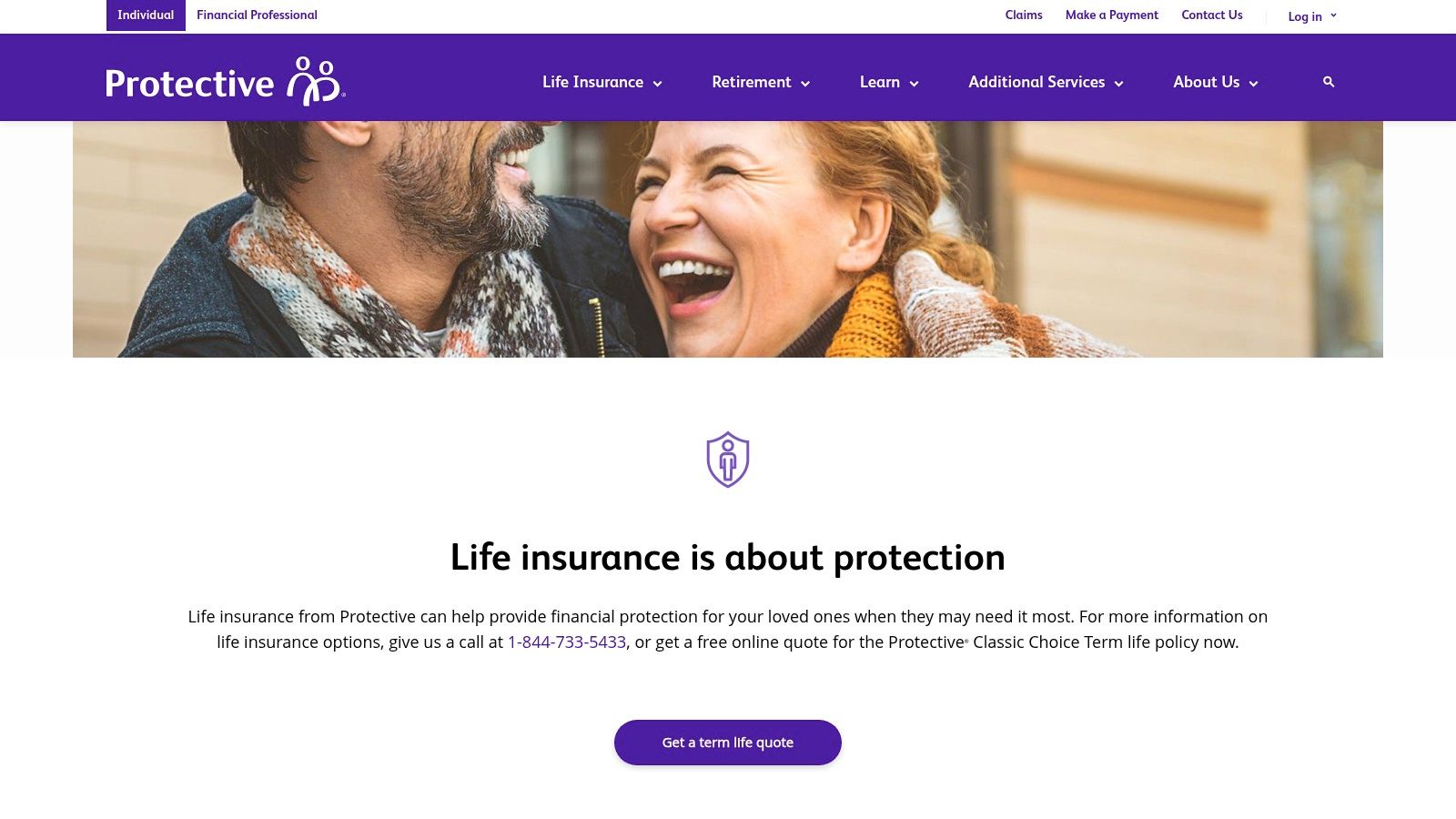

10. Protective Life

Protective Life offers a compelling blend of affordability, comprehensive coverage, and financial stability, making them an excellent option for budget-conscious individuals and families seeking long-term security. With over a century of experience, they’ve carved out a niche by providing some of the most competitive rates in the industry, especially for term life insurance. This makes them a solid choice for those prioritizing value and financial prudence.

Protective Life’s extensive range of policy options caters to diverse needs. Whether you're a young family looking for affordable term life coverage or an individual approaching retirement considering permanent options, Protective Life offers solutions. Their term life policies provide coverage from $100,000 to $50 million, with terms ranging from 10 to 40 years – a notable feature as few competitors offer 35 and 40-year terms. This long-term coverage is particularly appealing for those seeking peace of mind knowing their loved ones will be protected for decades to come. Their flagship Protective Classic Choice Term policy is particularly noteworthy for its competitive pricing and the flexibility to convert to permanent insurance later, adapting to your evolving financial landscape.

For those interested in building cash value, Protective also offers universal life policies, including their Custom Choice UL, a unique product that initially functions like term life but doesn't expire. This can be a powerful tool for long-term financial planning. This array of options makes Protective Life suitable for a broad spectrum of needs, from basic protection to more comprehensive estate planning.

For the Conservative American Family: Protective Life’s financial strength (A+ rating from AM Best) provides a sense of security and reliability, reflecting the values of stability and long-term planning that resonate with this demographic.

Individuals Approaching Retirement: The option to convert term policies to permanent coverage allows for a seamless transition into retirement, ensuring continued protection without the pressure of escalating term life premiums. The various universal life options also provide opportunities for cash value accumulation.

Health-Conscious Consumers: While a medical exam is typically required, Protective Life’s competitive pricing can offset this for healthy individuals who qualify for lower premiums. Securing affordable coverage early can be especially beneficial for those prioritizing long-term health and financial well-being.

Budget-Minded Insurance Shoppers: Protective Life’s consistently low premiums for term life insurance make them a top contender for those seeking maximum coverage for their dollar. The ability to customize coverage amounts and term lengths provides further control over costs.

Patriotic Individuals: As a company with a long history in the United States, Protective Life appeals to those who prefer supporting established domestic institutions.

Pros:

Consistently among the lowest premiums for term life insurance

Unusually long term options (up to 40 years)

Strong financial ratings (A+ from AM Best)

Flexible conversion options for changing insurance needs

Cons:

Application process typically requires a medical exam

Customer experience ratings slightly below some competitors

Online tools and interface less developed than newer insurtechs

Protective Life’s combination of competitive pricing, flexible policy options, and robust financial standing makes it a standout choice in the affordable life insurance landscape. While the application process and online interface might not be as streamlined as some newer competitors, the value and security they offer are hard to ignore. For individuals prioritizing affordability and long-term protection, Protective Life is definitely worth considering.

Affordable Life Insurance: Top 10 Comparison

Provider | Core Features ✨ | User Experience ★ | Value Proposition 💰 | Target Audience 👥 |

|---|---|---|---|---|

🏆 America First Financial | Affordable term, disability, annuities, long care; fast online quotes | Quick (<3 min), hassle-free | Low cost, ethical, philanthropic | Conservative, patriotic families |

Haven Life | Instant term coverage; no exam for eligible | Streamlined digital process | Competitive rates; backed by MassMutual | Young, tech-savvy applicants |

Bestow | Fully online term; no medical exam required | Ultra-fast approval (<10 min) | Simple process, competitive pricing | Budget-conscious, digital users |

Fabric | Term life with will creation & finance dashboard | Smooth mobile app; fast process | Affordable for young families with bonus tools | Young parents, family planners |

Ladder | Flexible, adjustable coverage amounts | Instant decisions; digital and fee-free | High coverage with price lock guarantee | Growing professionals, families |

State Farm | Multiple policy types; local agent support | Personalized service; traditional approach | Trusted brand with bundling discounts | Broad, traditional consumers |

Ethos | Term & whole life; many policies without exam | Simplified online application; quick decisions | Data-driven pricing; affordable coverage | Diverse age range, online shoppers |

Northwestern Mutual | Comprehensive coverage with tailored policies | Advisor-led process; in-depth evaluation | Strong dividends and cash value growth | Traditional, advisory seekers |

Policygenius | Insurance marketplace; compare multiple quotes | User-friendly platform; expert guidance | Wide selection; unbiased assistance | Informed shoppers, comparison seekers |

Protective Life | Term life up to 40 years; convertible options | Straightforward process; competitive rates | Among lowest premiums; long term options | Budget-focused, long-term planners |

Securing Your Peace of Mind: Making the Right Choice

Choosing the right life insurance policy can feel overwhelming, but with the right tools and information, it can be a manageable and empowering process. We've explored ten diverse options, from established companies like State Farm and Northwestern Mutual to innovative online platforms like Haven Life, Bestow, Fabric, Ladder, Ethos, and Policygenius. Remember, the best choice for you depends on your specific circumstances. Factors like your age, health, financial goals, and budget will play a key role in determining which provider and policy type best suits your needs. For example, younger families building their financial foundation might find Fabric's streamlined online application appealing, while those approaching retirement may prioritize the experience and personalized advice offered by Northwestern Mutual.

To help you navigate the often complex process of selecting a life insurance policy, we recommend checking out this comprehensive guide: 2025 guide to choosing the best life insurance policy. This resource provides valuable insights to help you make informed decisions about your coverage. It’s important to compare quotes from various companies, including those mentioned here like Protective Life, before making a final decision. Obtaining personalized quotes will provide tailored pricing based on your individual needs.

Taking the time to research and compare options now will pay off in the long run, providing you with the peace of mind that comes from knowing your loved ones are protected. For those seeking affordable options with a focus on American values, explore how America First Financial can help protect your family's future by offering competitive rates and a commitment to financial strength. Securing your family's financial future is a testament to your love and foresight – take the first step today.

_edited.png)

Comments